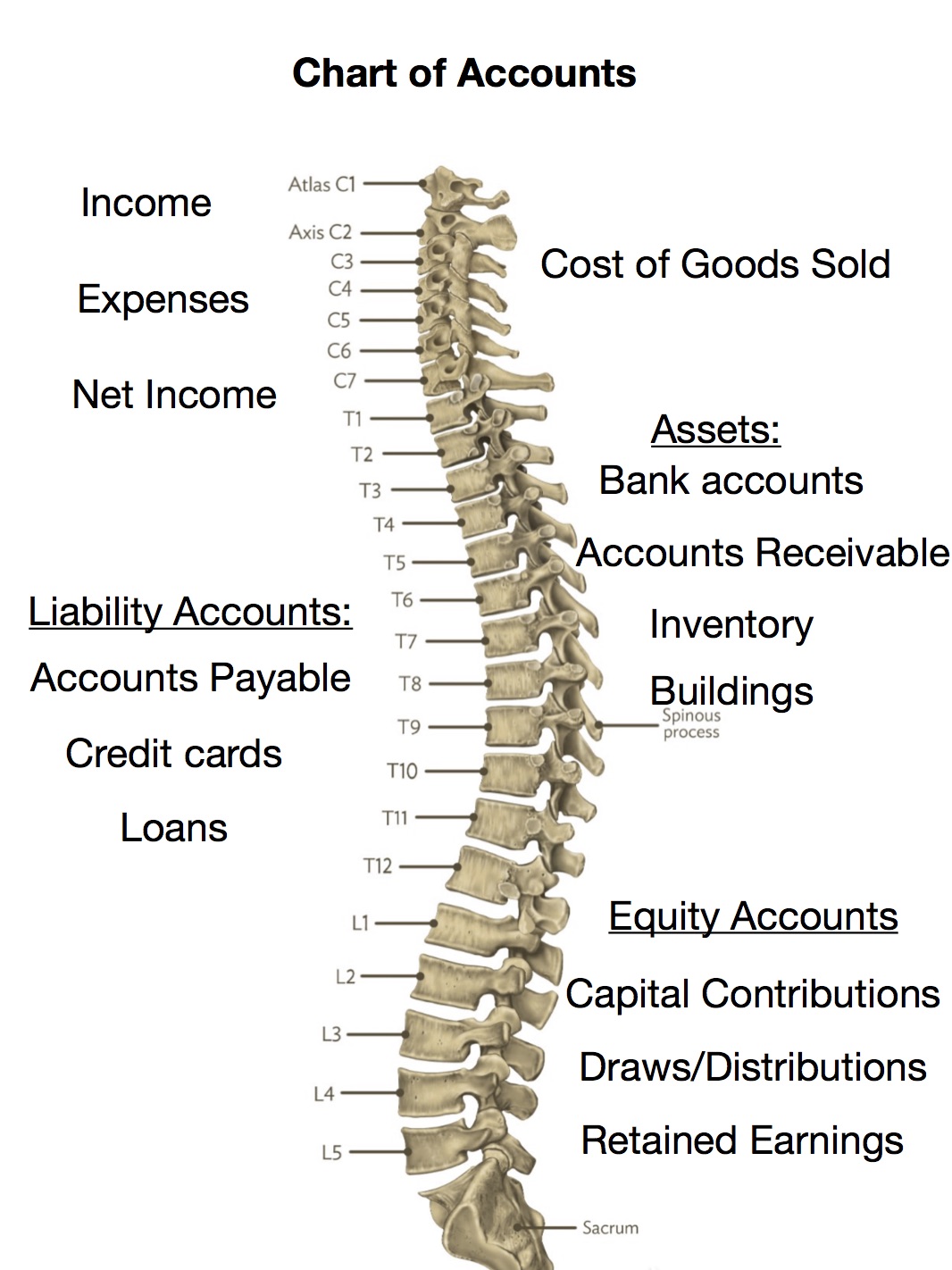

What is your Chart of accounts? It is simply a list of every single account in your accounting system. This includes “accounting” accounts such as income & expenses that are used for classification purposes. It also includes your balance sheet accounts, the “real” accounts, that house your companies assets, liabilities and equity.

This what your chart of accounts looks like:

Condensed Chart of accounts:

Insurance Expense

You have one major account for all types of insurance.

This is a detailed chart of accounts – this is what CFO’s use to run your company better.

| Insurance Expense: |

| Disability Insurance |

| General Liability Insurance |

| Health Insurance |

| Malpractice Insurance |

| Workers Comp Insurance |

Income & Expense accounts – are temporary accounts. They zero out at the end of every time period.

Real accounts: balance sheet accounts: are ACCUMULATIVE. The balances accumulate over time. These include bank accounts, inventory, fixed assets, credit cards, loans, equity, draws& distributions, and capital contributions.

If you have a detailed chart of accounts it allows you to manage your costs & expenses better. You can always condense the report and only look at the major accounts. If you only have major categories in your chart of accounts you will not see the detail that you need to manage your expenses or view your income in detail.

Yes, you can get the detail on a detailed profit & loss or general ledger but it takes a lot of time to sort through the transactions. Or you have to export it to excel and sort the data. This takes a lot more time and effort, which is something that most small business owners do not have.

Also, when you see a company with only a condensed chart of accounts, be careful. Sometimes this how businesses “hide” things. It makes it easier to commit tax fraud which is not a good idea. It makes it more difficult to run your company.

If you are making a lot of money, you may not care where the money goes, but you should. A larger company has even more to lose.

As a controller, I want to see the detail right up front. I can tell if you are overpaying for workers comp. I can see errors in your classification right away. Don’t hide things. Make your system very transparent.

Keeping a clean set of books starts with a good chart of accounts. Using numbers to run your business better start with a good chart of accounts. Knowing where the income is coming from starts with a good chart of accounts.

If you want to run your business better, create a good chart of accounts.

Yes, your chart of accounts will change over time. This is natural and normal. It will expand and grow as your company expands and grows. Your accounting system as a whole will do this.

Get off to a good start and have a good chart of accounts from Day 1.

Here’s to a successful business.

Deb

+ show Comments

- Hide Comments

add a comment