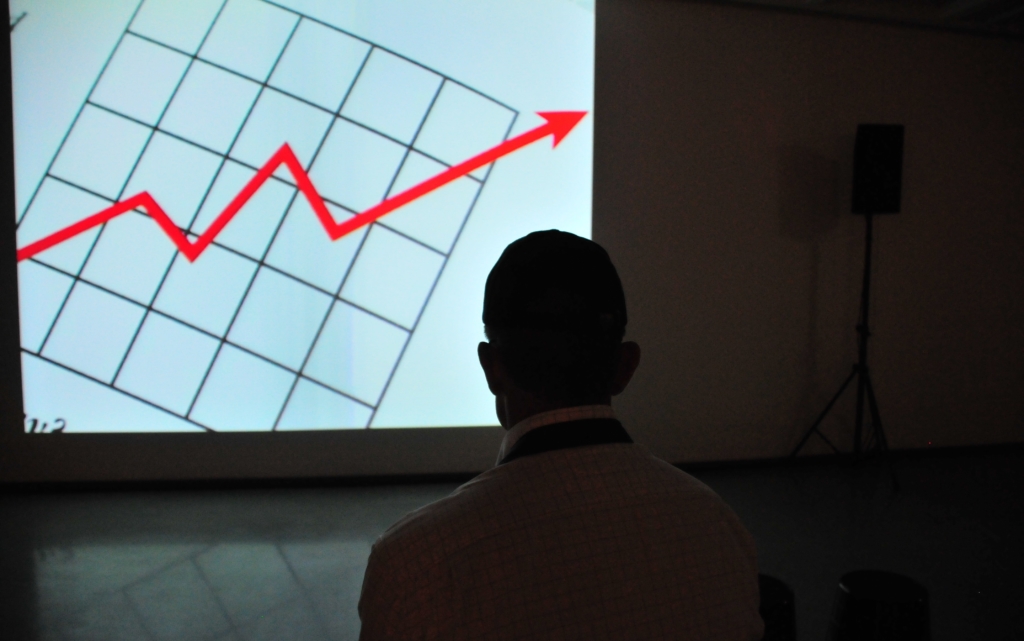

What is the difference between simple interest and compound interest?

Everything.

Simple interest is calculated once. Compound interest grows and grows. Compound interest can work for you or it can work against you. Let’s take a look at simple interest and compound interest in action.

Loans or liabilities:

In the case of a loan, simple interest is calculated once and added to the loan. You have the principal and the interest added together. That gives you the total amount of the loan. You do not have to pay interest on interest.

A good example of this is a car loan or a personal loan from your credit union.

Here’s the breakdown:

Simple loan:

Principal $20,000

Term: 5 years = 72 monthly payments

Interest rate: 10%

Total interest = $20,000 x .10 = $2,000

Total cost: $22,000

Monthly payment = $305.55

Compound interest is the opposite of simple interest.

With compound interest, you end up paying interest on interest or earning interest on your interest.

In the case of a loan or credit card, the interest is calculated each month and continually added to the balance of the loan if you don’t pay it off in full.

When it is your investment and you are earning interest on interest, it’s great. Compound interest in your favor is how people build wealth. This is putting your money to work for you.

Compound interest on credit cards is a prime example of compound interest working against you. It is absolutely on of the worst financial thing ever. Don’t do this to yourself. This is how people get into financial trouble. Please pay your credit card in full every month, unless it’s at zero percent interest and you have a plan to pay it off before that low rate expires.

Compound Interest:

Credit card balance: $20,000

Term – until paid off

Interest rate: 10%

| Principal | Interest | New total | Payment | Revised total | ||

| 20,000.00 | 166.67 | 20,166.67 | 300.00 | 19,866.67 | ||

| 19,866.67 | 165.56 | 20,032.22 | 300.00 | 19,732.22 | ||

| 19,732.22 | 164.44 | 19,896.66 | 300.00 | 19,596.66 | ||

| 19,596.66 | 163.31 | 19,759.96 | 300.00 | 19,459.96 | ||

| 19,459.96 | 162.17 | 19,622.13 | 300.00 | 19,322.13 | ||

| 19,322.13 | 161.02 | 19,483.15 | 300.00 | 19,183.15 | ||

| 19,183.15 | 159.86 | 19,343.01 | 300.00 | 19,043.01 | ||

| 19,043.01 | 158.69 | 19,201.70 | 300.00 | 18,901.70 | ||

| 18,901.70 | 157.51 | 19,059.21 | 300.00 | 18,759.21 | ||

| 18,759.21 | 156.33 | 18,915.54 | 300.00 | 18,615.54 | ||

| 18,615.54 | 155.13 | 18,770.67 | 300.00 | 18,470.67 | ||

| 18,470.67 | 153.92 | 18,624.59 | 300.00 | 18,324.59 | ||

| Total 1 year | 1,924.59 | 3,600.00 | $18,324.59 | Balance after 12 months | ||

After paying $3,600 on the credit card in a year, the balance has only decreased by $1,100. Why? Because of the compound interest. This example used the rate of 12.9% which is not bad for a credit card at this time but it is not a good use of your money.

If you have debt with compound interest, make a plan to get it paid off as soon as you can. Then put that monthly payments into an investment account where you can earn compound interest.

Compound interest can work for you or against you. Put it to work for you. That is a great use of your money.

- This post originally appeared on Crunch the Numbers.org website in March 2017.