The people & positions in your accounting system.

CFO

Controller

FC Bookkeeper

Bookkeeper

AR Clerk

AP Clerk

Okay, some of you are asking, did she really need to write about this? Yes, I do. Too often business owners don’t understand who does what in the accounting department. Or worse, they call everyone a bookkeeper from the AR clerk to the controller or accounting manager.

I have cleaned up so many messes because the business owner thought they could spend $10 an hour on a bookkeeper and get an accountant. Uh, no, it doesn’t work that way.

Since the financial meltdown in 2008, I have seen a lot of ads or classes that tell you that anyone can do bookkeeping or taxes. On one hand, anyone can learn accounting but on the other hand you have to start at the bottom and work your way up.

There is a CPA teaching classes on line telling people they can do taxes with no experience. Yeah, you can do a 1040 EZ form but you aren’t touching my tax return (corporate or personal) or my clients tax returns.

Accounting is not just about a degree, it’s about experience and knowledge. I want to review the different positions in an accounting department and what they do so that you, the business owner, understand what you’re looking for and who to hire so that you get the numbers you need to help you run your business.

Companies vary from industry to industry but here is a general view of the positions and people in your accounting system.

CFO: Chief Financial Officer. Most small companies under $40 million are not going to have a CFO. The CFO is mainly there for budgets, projections, financing the company’s growth, watching debt levels, managing all things financial including taxes.

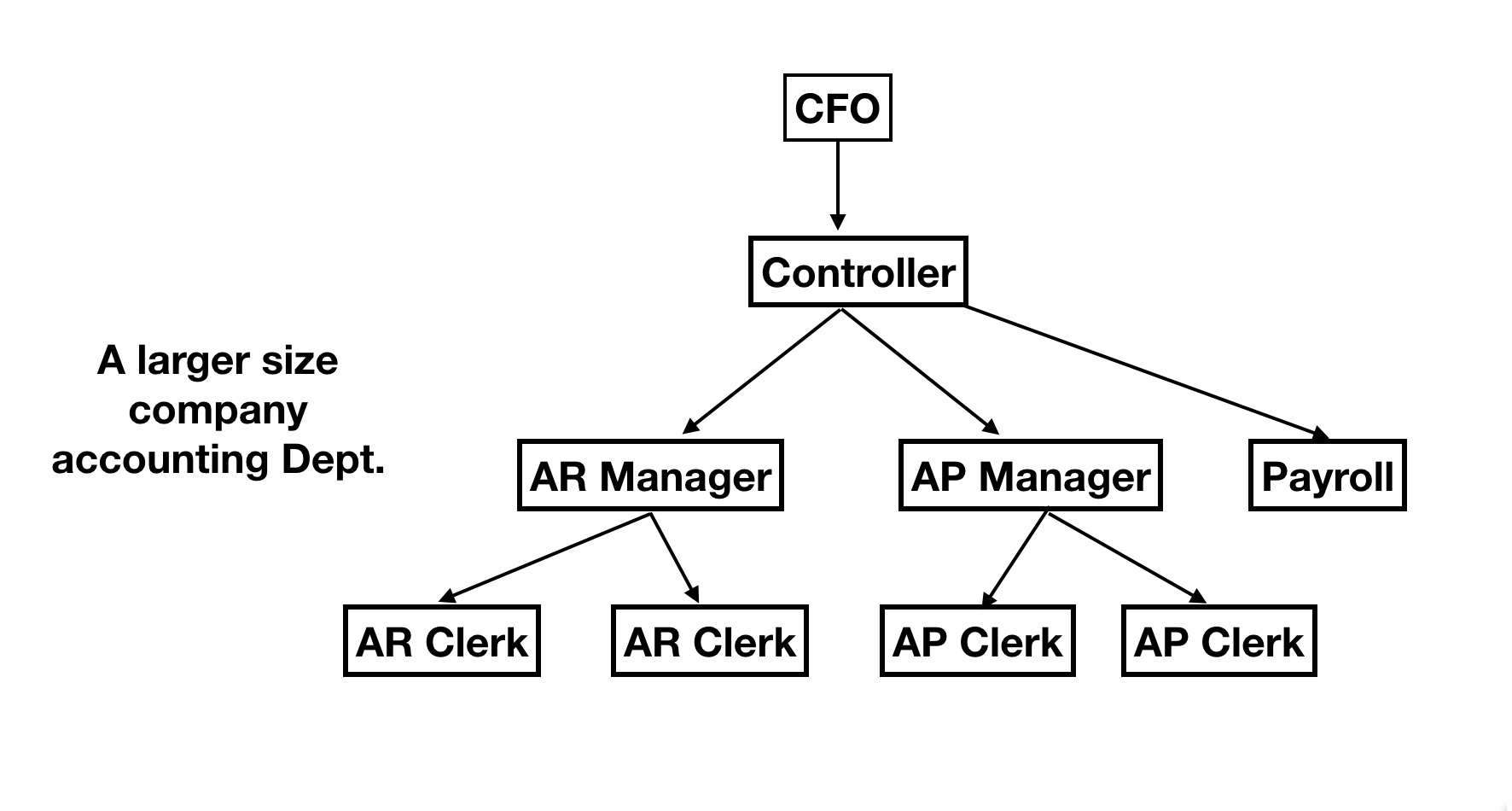

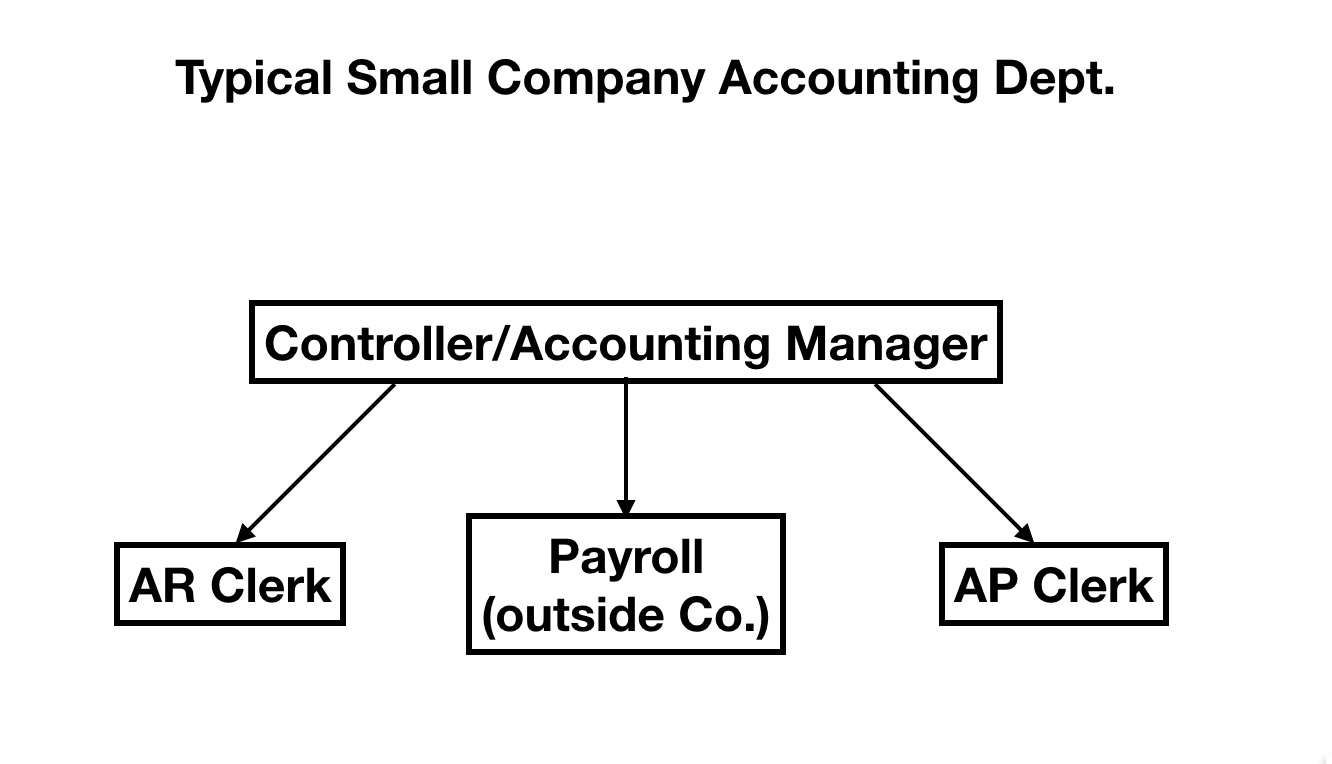

Controller or Accounting Manager: runs the accounting department. All accounting and finance operations report to this person. From the AR clerk and AP clerk to the bookkeeper, they will all report to the controller. In manufacturing companies where warehouse or customer service people create the invoices, then customer service department usually reports to accounting as well.

The controller is responsible for the day-to-day operations including payables, receivables, payroll and most importantly cash flow. Cash flow is the life-blood of all companies. Sales people will tell you that sales/revenue is most important but if you can collect the money, it doesn’t do you any good. Cash flow requires most of the time and importance for the controller’s attention. In addition to taxes, licenses, insurance, budgets, financing issues and more.

Depending upon the type of company and industry, the controller usually has at least an AR person and an AP person and possibly a bookkeeper working underneath them. Some companies have both high AR needs and high AP needs but some companies need one more than the other.

In the apparel industry, if you have a lot of boutique clients, you ship a lot of small packages to many customers. This requires heavy-duty invoicing and customer payments. At one company, I had an AR manager plus a customer service manager and two AR customer service reps working for me. On the AP side, I only needed one AP clerk to handle the PO’s and vendor bills. Obviously, we had a good production manager working with us on the AP side.

I have a friend who is controller for a consulting firm. At $20 million a year, he was the only person in accounting. It took a long fight for him to be able to hire a bookkeeper. To me, that is just silly. Yes, you can automate a lot of your accounting but you want your controller doing the heavy duty item like budgets, financing growth or managing debt, managing cash flow, not doing data entry like entering bills. He was finally able to get some help and hire someone. Being a service based business made it easier to have a one-person accounting team.

FC Bookkeeper: a full charge bookkeeper. What does this mean? It means they can reconcile the books at the end of the month. People have muddled the term bookkeeper and anyone crunching numbers seems to have the title. Full charge bookkeepers reconcile the books each month after making sure that the AR, AP and payroll are entered correctly. They also add any journal entries needed to completely close the books and produce good financial reports. They also can do job costing, taxes, licenses, insurance and Human Resources.

Bookkeepers: a good solid bookkeeper can handle your accounts receivable, accounts payable and payroll. If it is a lower level bookkeeper or employee, the payroll should be done by the controller, an outside bookkeeper or the owner.

Do NOT ever allow a lower level employee to handle your payroll.

Bookkeepers should be able to reconcile the accounts. But they will not usually do journal entries, taxes, cash flow reports and any higher-level activity. Lower level bookkeepers will not or should not be reconciling the books at the end of the month. Don’t be fooled by easy software like Quickbooks online that make it simply. You need to understand what goes into this and not just hit a button and hope the computer is correct.

The term bookkeeper has been misused and a lot of clerks are called bookkeepers when they really are just clerks. This has led a lot of companies astray. Some of this is the business owner’s own fault for being cheap and part of it is the lack of knowledge in general about who does what in accounting.

AR Clerk: Accounts Receivable Clerk. This person could also be a warehouse person or customer service representative who assist with the invoicing. The difference between customer service person who invoices the customer and an AR Clerk is the customer service rep will never get a check payment and apply it to the invoice. Although they may take credit card numbers over the phone, all checks go to the accounting department for processing.

A true AR clerk will generate invoices, accept customer payments and apply them to the invoice. They may also do assignments to the factor. They should also be aware of shortages and credit memos and Return Authorizations, which should be managed by the customer service manager or AR manager.

AR Manager: overseas all of the AR clerks. Managed return authorizations and chargebacks. Usually, but not always, there is a separate AR software used for invoicing instead of the overall software. Many small companies use Quick books for their overall accounting software but have a separate more complex software for AR.

Once your company gets larger you can move up to an all-encompassing system like Great Plains. Service based businesses can get away with invoicing out of Quickbooks except for specialties such as attorneys or consultants who use time tracking software such as time slips.

AP Clerk: Accounts Payable Clerk: This person is responsible for entering all bills from your vendors. The purchase order system also fall to either this person but will be watched over by the production manager or controller.

So all this person does is enter and pay bills? It’s not as easy as it sounds. They also need to track packing lists, and account for all deliveries to the warehouse. At least 1 person in the warehouse needs to count every shipment coming in and notify AP & Accounting when there is a shortage. Chargebacks occur on both sides of the accounting department and having 1 person in charge of this makes it much easier to track.

Here is a visual of a typical accounting system at a small company. A product based company would have multiple clerks, usually in AR like the first graph shown above. A service based company can get away with 1 clerk/bookkeeper plus a more experienced FC Bookkeeper or sometimes a controller (if you can afford one) closing the books each month.

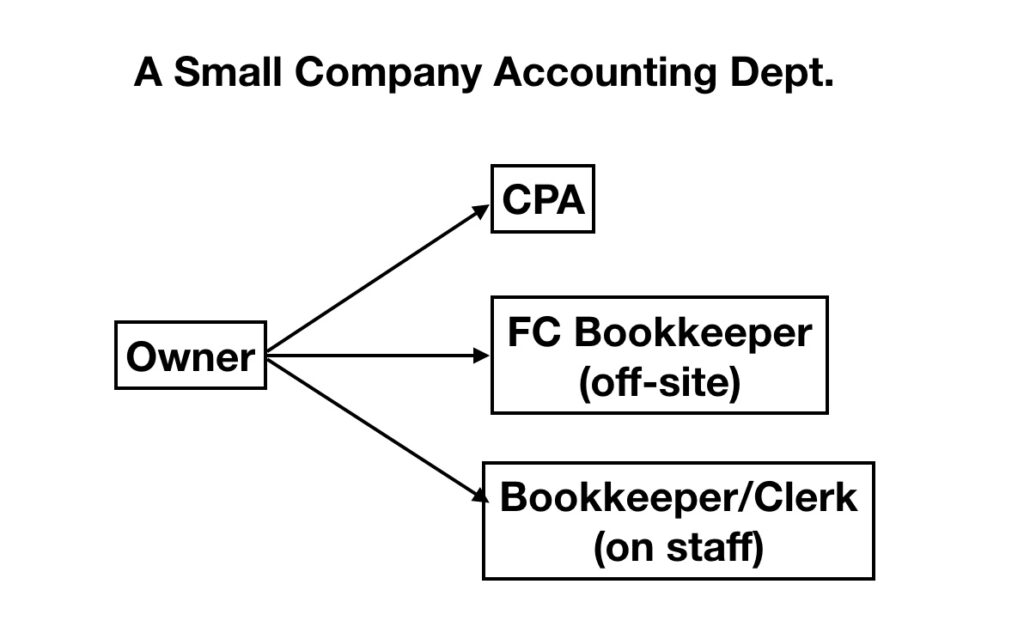

Below is your beginning accounting system Your accounting system maybe only one person at the beginning. This is usually an outside bookkeeper who may or may not come on site on a regular basis. You will see your CPA somewhere between 1-3 times a year. As you grow larger you may end up with a clerk or bookkeeper on staff but still have a more experienced person closing the books at month end.

You need to understand that your needs as a business owner depend upon your company and the industry you are in. Product-based companies versus service-based companies, companies that bill based on time, how you sell your products, these are all variables that affect your needs in the accounting department. Also, you needs will change as the company grows and changes.

Two things you need to do to help yourself. ONE: Get your accounting system set up correctly in the beginning. Don’t be cheap. Get a good system in place and then you can have an average person run it. TWO: Get your accounting in place as soon as possible. Don’t wait for tax season to figure out where you are. That creates a nightmare for everyone and it will cost you more money.

Get peace of mind and get a good accounting system in place at the beginning of your company.

Please feel free to ask questions and/or leave comments below.

Deb

+ show Comments

- Hide Comments

add a comment